Introducing an ambitious investment fund that combines a novel approach to client relationships with a unique systematic investment strategy.

It is one of a kind!

Lucy sets a new benchmark of how asset managers should treat their clients. The times of high unfair fees, and lack of transparency are in the past.

Welcome to a new era of fair pricing, complete transparency, and love of communication.

How does the pricing work?

Very simply, the underlying idea is that Lucy makes money only when you make money – we’re in this together! Other asset managers don’t do this – they will take their fees, even if they did not perform well.

This means that if Lucy’s European Equities, for example, generate negative performance in a given year, then, our management fee will be reduced. Only when we generate positive performance, Lucy’s management fee goes up to a maximum of 1,85 %.

In a nutshell, we want to align our interests with you.

What is this complete transparency about?

It means that Lucy is completely open with you. It means no more ‘black box’ investing where you have no idea what's going on with your money.

With Lucy, you have a full insight into what is happening to your investments. You can see your whole investment portfolio, the sectors you own, countries selected, and currency allocations.

Below, you can get an idea of what this transparency means in practice. Try playing around with our interactive graphic. It’s like an X-ray which allows you to see right through Lucy. Heard some positive news about a certain company? Check to see if you own it through Lucy!

Pick any of the Forward Lucy funds to see the specific details

Select a past month to read our market commentary and see how we adapt the asset allocation to changing market conditions

Deep dive into the holdings of the funds and select a date to retrace Lucy’s development in the past

Tip: By keeping the Ctrl-key pressed, you can filter multiple holdings, countries, currencies or sectors at the same time to make your own analysis.

What about communication?

Anything you might want to observe or analyze is here. Lucy is an open book, with absolutely nothing to hide.

Five words: Lucy is there for you.

Lucy likes to talk and write, which means that you can stay informed about what's going on with your investments, whether it's good or not. Indeed, if the performance isn’t going well in a certain period, you will get an answer to why that is happening.

Compared to other asset managers, Lucy doesn't bury its head in the sand and expect you not to ask questions. Quite the contrary: it will tell you everything as it is.

We want you to have no open questions. No matter how much money you invest, if you have a question or comment, you will be heard and taken care of.

Besides pricing, transparency and communication, what makes Lucy special is how it invests.

At the heart of Lucy is an ever-evolving modern algorithm that has many different aspects. The main one, though, is what we call the ‘sentiment scanner’.

We can use it to determine the mood prevailing in the markets at the moment. Yes, economic data and politics are important for market behavior, but much more crucial is what the market ‘thinks’ about those things.

Perception is a key factor. When the market feels increasingly euphoric, prices will rise. When discouragement sets in, the trend will go down. Using Lucy's approach, we can understand what the market's emotional state is.

So, how does it work?

Lucy does it by analysing all the economic news from around the world and, by dissecting the patterns of the text, tells us what emotional state is prevalent at the moment. That's quite something!

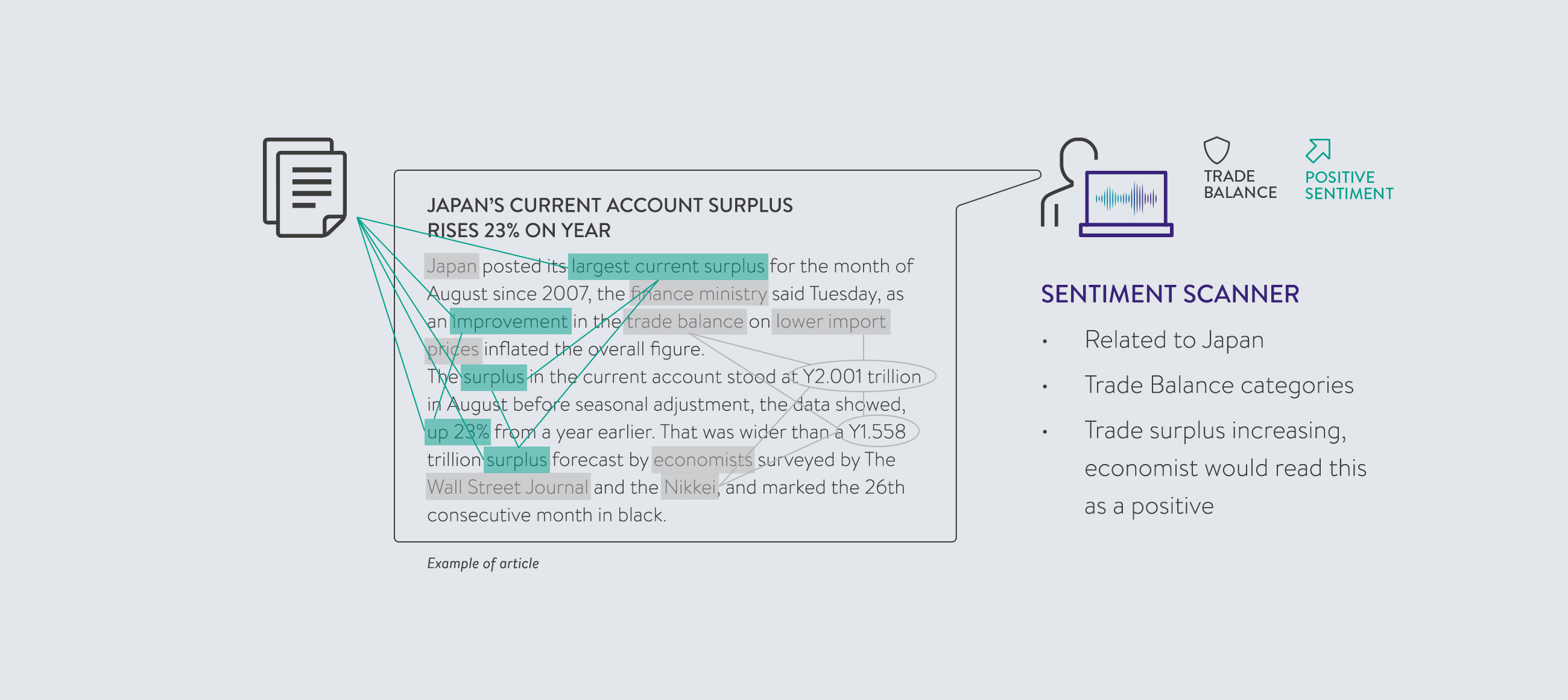

You can see this in the example of Japan below.

An article comes in, and the algorithm automatically puts it under 'Japan'. Then, it also recognizes that it is about the balance of trade - the difference between imports and exports, and, most importantly, tells us that it is a positive favorable article. Japan's exports are growing, which, all things being equal, is a very good thing!

This is just one article. Every day, Lucy receives thousands of these articles from all the major countries and industries. Using this algorithm, Lucy can literally analyze and interpret millions of articles a year.

As a result, we can build a holistic picture - covering all countries and sectors around the world - and thus know how the market is 'feeling'.

And knowing the market's 'feeling' allows us to currently position the fund and thereby help you make money!

Lucy is truly the first of its kind. It offers a whole new approach to you, the client. And it also comes with an innovative investment engine that helps you reach your savings goals.